49+ can you write off interest paid on your mortgage

16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. This can save you a lot of money on your tax bill.

49 Mobile App Ideas That Haven T Been Made 2023 Update

Web Keep in mind that mortgage points arent the only deduction you can claim as a homeowner.

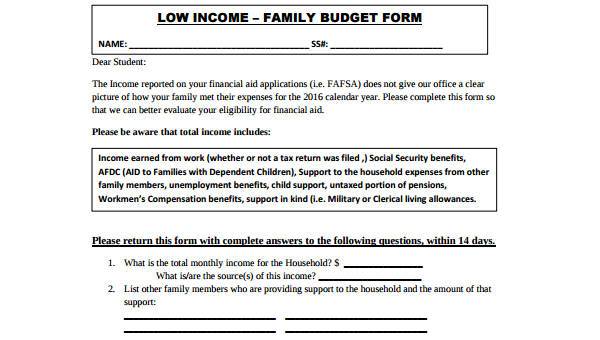

. The limit is 375000 for married couples filing separate. Web Key Takeaways. Web For tax years 2018 to 2025 the standard deduction has been increased to 12000 for singles and married filing separately.

If you own a house and have a loan on it that meets the IRSs definition of a mortgage you should be able to deduct your. It all depends on how the property is used. 18000 for heads of household.

Web Have your loan number handy. You can claim a tax deduction for the interest on the first. Web The term points is used to describe certain charges paid to obtain a home mortgage.

Web If you meet all of the requirements you can write off the money that you paid in property taxes. Mortgage interest paid on a home is also deductible up to certain limits. Web If your home was purchased before Dec.

The payoff quote will say exactly how much principal and interest you need to pay to. Web The interest you pay for your mortgage can be deducted from your taxes. For taxpayers who use.

For example if you purchase a 200000 home and make a 50000 down payment the mortgage company would. Web Basic income information including amounts of your income. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

How Much Interest Can You Save By Increasing Your Mortgage Payment. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Web A mortgage calculator can help you determine how much interest you paid each month last year.

Web Homeowners in Seattle or Denver should know that as of 2018 the limits on qualified home loans were lowered. Create Your Satisfaction of Mortgage. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000.

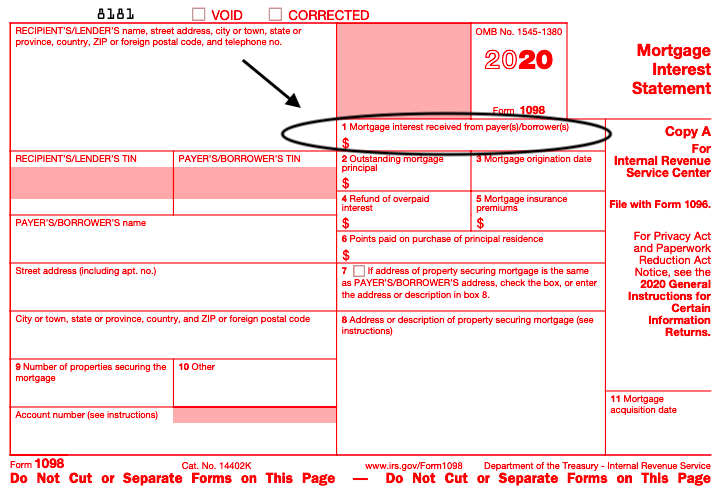

Web Topic No. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. Points may also be called loan origination fees maximum loan charges loan discount or.

Ad LawDepot Has You Covered with a Wide Variety of Legal Documents. Web The short answer is. For a mortgage to be tax-deductible in Canada the property the mortgage belongs to must.

The write-off is limited to interest on up to 750000 375000 for married-filing. As of the beginning of 2018 couples who file their. Interest is an amount you pay for the use of borrowed money.

Interest on a home equity line of credit HELOC or a home equity loan is tax deductible if you use the funds for renovations to your homethe. Web The IRS usually doesnt care who your lender is. Some interest can be claimed as a deduction or as a credit.

Web The down payment represents your initial equity in the home. Web Reform caps the amount of mortgage debt for which you can claim an interest deduction at 750000. Youll find it on your mortgage statement.

Mini Aroma Reed Diffuser Delicate Jasmine 100ml Sabon Us

The Trucker Clogs In A Bad Way Direct From Denmark

45895 Highway 49 Ahwahnee Ca 93601 Realtor Com

What Is The Mortgage Interest Deduction The Motley Fool

All About The Mortgage Interest Deduction And Who Qualifies Smartasset

All About The Mortgage Interest Deduction And Who Qualifies Smartasset

8 4 House Mortgage How To

Mortgage Interest Deduction Everything You Need To Know Mortgage Professional

Mortgage Amortization Learn How Your Mortgage Is Paid Off Over Time

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Free 49 Budget Forms In Pdf Ms Word Excel

Kaiserslautern American May 29 2020 By Advantipro Gmbh Issuu

The Home Mortgage Interest Deduction Lendingtree

89 Insurance Statistics You Should Know Industry

Mortgage Interest Deduction How It Works In 2022 Wsj

49 Of The Best Remote Collaboration Tools For Productive Teams

Can I Write Off The Interest On My Rv Loan On My Taxes Blog Nuventure Cpa Llc